Gross pay to hourly calculator

Annual salary 5200000 Monthly salary. Multiply the hourly wage by the number of.

Gross Pay And Net Pay What S The Difference Paycheckcity

The PAYE Calculator will auto calculate your saved Main gross salary.

. The gross pay estimator will give you an estimate of your gross pay based on your net pay for a particular pay period. Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes. Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes.

A pay period can be weekly fortnightly or monthly. Divide this number by the gross pay to determine the percentage of taxes taken out of a paycheck. The gross income calculator allows you to adjust the regular.

It can be used for the. SmartAssets North Carolina paycheck calculator shows your hourly and salary income after federal state and local taxes. Tool Gross pay calculator Plug in the amount of money youd like to take home each pay period and this calculator will tell you what your before-tax earnings need to be.

Federal Gross-Up Calculator or Select a state Use this federal gross pay calculator to gross up wages based on net pay. Gross pay is the amount of money that you make before taxes and other deductions that are subtracted from your income. To calculate the hourly rate of your earnings divide the total hours worked in a year by the annual earnings.

Use SmartAssets paycheck calculator to calculate your take. To do this quickly in your head you would drop 3 zeros from your annual salary. As can be seen the hourly rate is multiplied by the number of working days a year unadjusted and subsequently multiplied by the number of hours in a working day.

If you have a monthly salary multiple it by 12 to get an annual. The following figures will result. You can change the calculation by saving a new Main income.

Example of a calculation Lets assume an individual earns 25hour while he works an average of 40 hoursweek. Try out the take-home calculator choose the 202223 tax year and see how it affects. 45 000 - Taxes - Surtax - CPP - EI 35.

Take for example a salaried worker who earns an annual gross salary of 45000 for 40 hours a week and has worked 52 weeks during the year. For example if an employee receives 500 in take-home pay this. For example if an employee earns 1500 per week the individuals annual.

How do I calculate salary to hourly wage. To stop the auto-calculation you will need to delete. To calculate an annual salary multiply the gross pay before tax deductions by the number of pay periods per year.

The Salary Calculator has been updated with the latest tax rates which take effect from April 2022. If you work a 2000 hour work year then divide your annual earnings by 2000 to figure out your hourly wage. Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes.

3 Ways To Calculate Your Hourly Rate Wikihow

Hourly Paycheck Calculator Step By Step With Examples

Gross Pay And Net Pay What S The Difference Paycheckcity

Hourly Pay Calculator Clearance 53 Off Ilikepinga Com

Hourly Pay Calculator Clearance 53 Off Ilikepinga Com

Calculating Income Hourly Wage Youtube

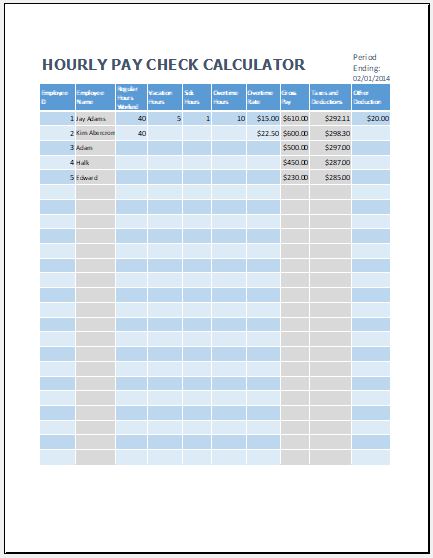

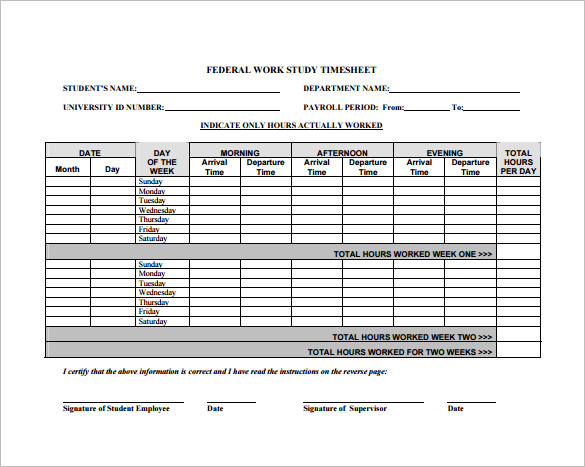

8 Hourly Paycheck Calculator Doc Excel Pdf Free Premium Templates

Hourly To Annual Salary Calculator Deals 53 Off Ilikepinga Com

Hourly To Salary What Is My Annual Income

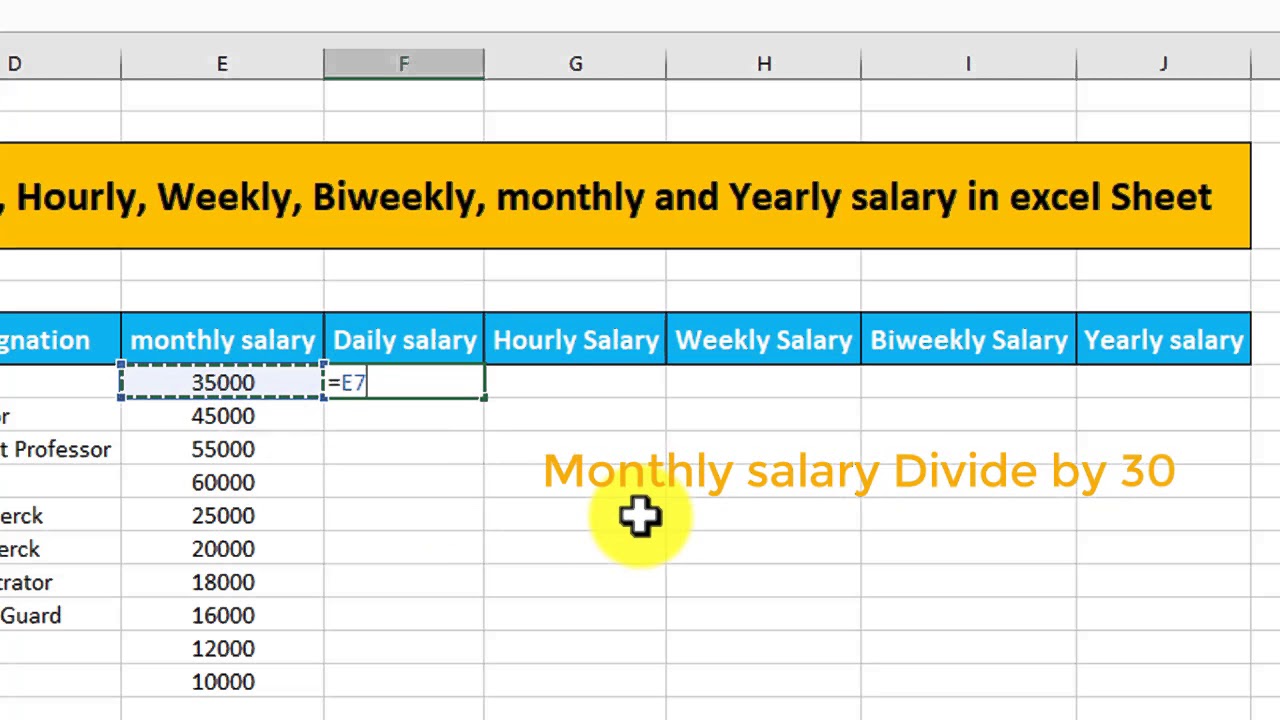

How To Calculate Daily Hourly Weekly Biweekly And Yearly Salary In Excel Sheet Youtube

Top 5 Hourly Paycheck Calculator Can Make Your Life Easy

Salary Calculator

How To Calculate Payroll For Hourly Employees Sling

Annual Income Calculator

8 Hourly Paycheck Calculator Doc Excel Pdf Free Premium Templates

Salary To Hourly Salary Converter Salary Hour Calculators

Hourly Rate Calculator Plan Projections